IPO vs Pref stack

One reason the market for acquisitions might be closed if your sale valuation would be lower than your previous valuation is that your choices are:

One reason the market for acquisitions might be closed if your sale valuation would be lower than your previous valuation is that your choices are:

- Sell privately and the founders get killed by the preference stack, or

- IPO and the pref stack gets wiped out (prefs don't survive IPOs).

Theoretically, you could negotiate somewhere in between but it's hard and some VCs will have told their investors the investment has held its value because of the preference.

Great food and advice

Anyone can “start,” only the thoroughbred will “finish!”

Anyone can “start,” only the thoroughbred will “finish!”

Thank you Sohunan of San Francisco for the great food and advice.

Super random

I bumped into Grant MacLennan who works one desk apart in the same office as Euan Cameron 🚀.

I bumped into Grant MacLennan who works one desk apart in the same office as Euan Cameron 🚀.

We've never met before. We are staying in the same hotel in San Francisco. He saw the Willo® sticker on my laptop.

Evening update - 25 Apr 24

Today I…

#TodayI

Met two funds with 9 digits assets under management, one with 10 digits and one with 11.

Was helped out by a friendly staff member when neither of my payment methods worked on the train.

Attended the British Benevolent Society of California, Inc. AGM and reception.

24 hours later

I landed in San Francisco, have been awake approaching twenty-four hours, and just attended a Brex VC-Founder mixer I found via Jonathan Chang's SF IRL newsletter.

I landed in San Francisco, have been awake approaching twenty-four hours, and just attended a Brex VC-Founder mixer I found via Jonathan Chang's SF IRL newsletter.

Tomorrow is filled with VC meetings in Palo Alto and Sand Hill Road.

Reminder: I'm here primarily to meet VCs who can follow on in my portfolio focused on UK early-stage digital tech startups.

Why go to the States

A reminder of why I'm flying to San Francisco:

A reminder of why I'm flying to San Francisco:

- It is hard to achieve the biggest outcomes without selling in the States

- It is helpful to have a US VC on board to do that

- Warm intros help and most European VCs don't have those connections

- I am meeting funds so they know me well enough I can make those intros

- I will learn their requirements so I only send them the right things

- I can feed that back to my portfolio companies so they can present themselves well and make sure they are on the right path if that's the path they choose

- Given the biggest outcomes often require going to the States, I can feed their requirements into my investment criteria

See you on the other side.

Drawing a crowd

Yesterday I was fortunate to have the pleasure to speak at the Rare Founders conference and demo day.

Yesterday I was fortunate to have the pleasure to speak at the Rare Founders conference and demo day.

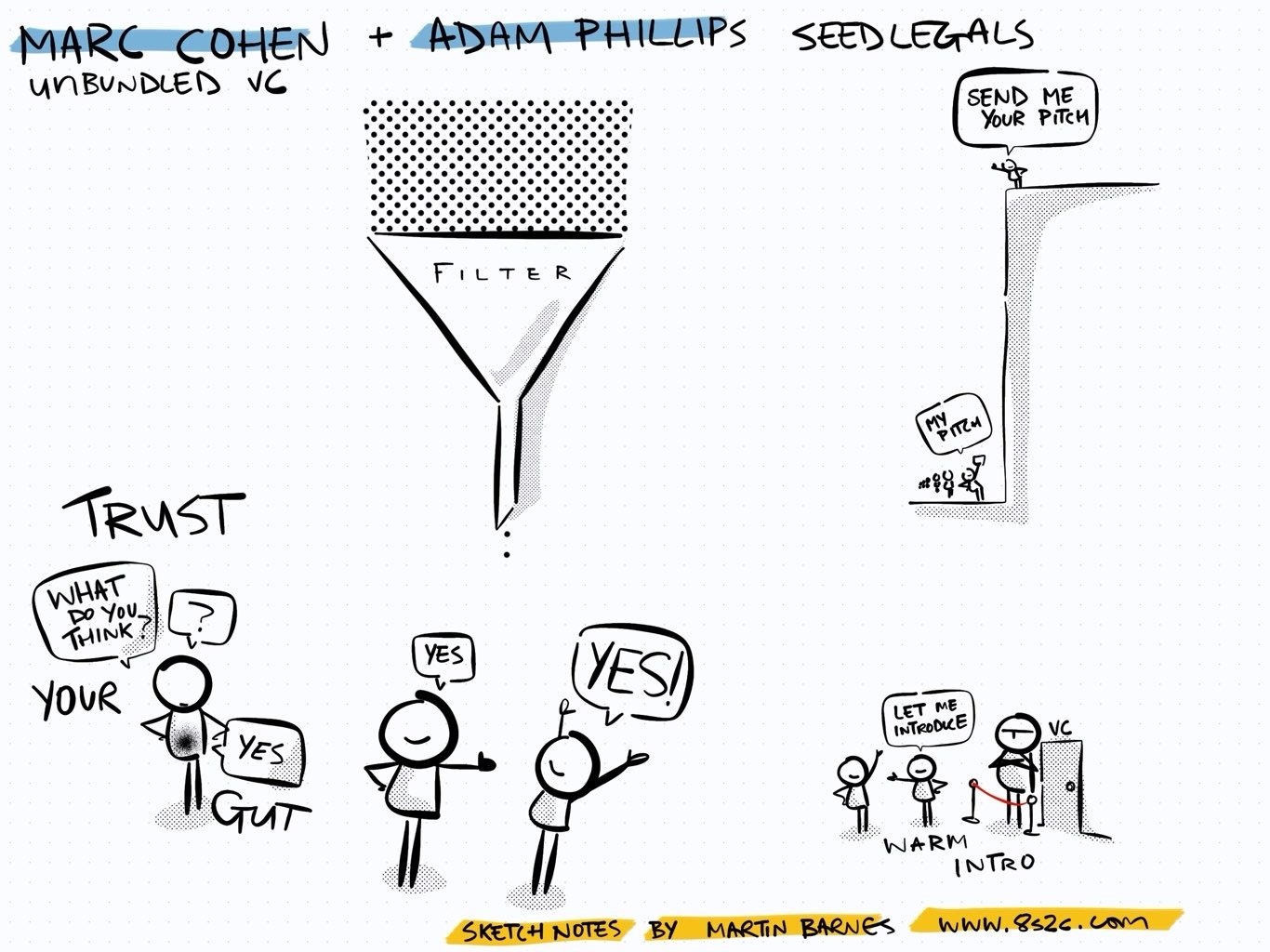

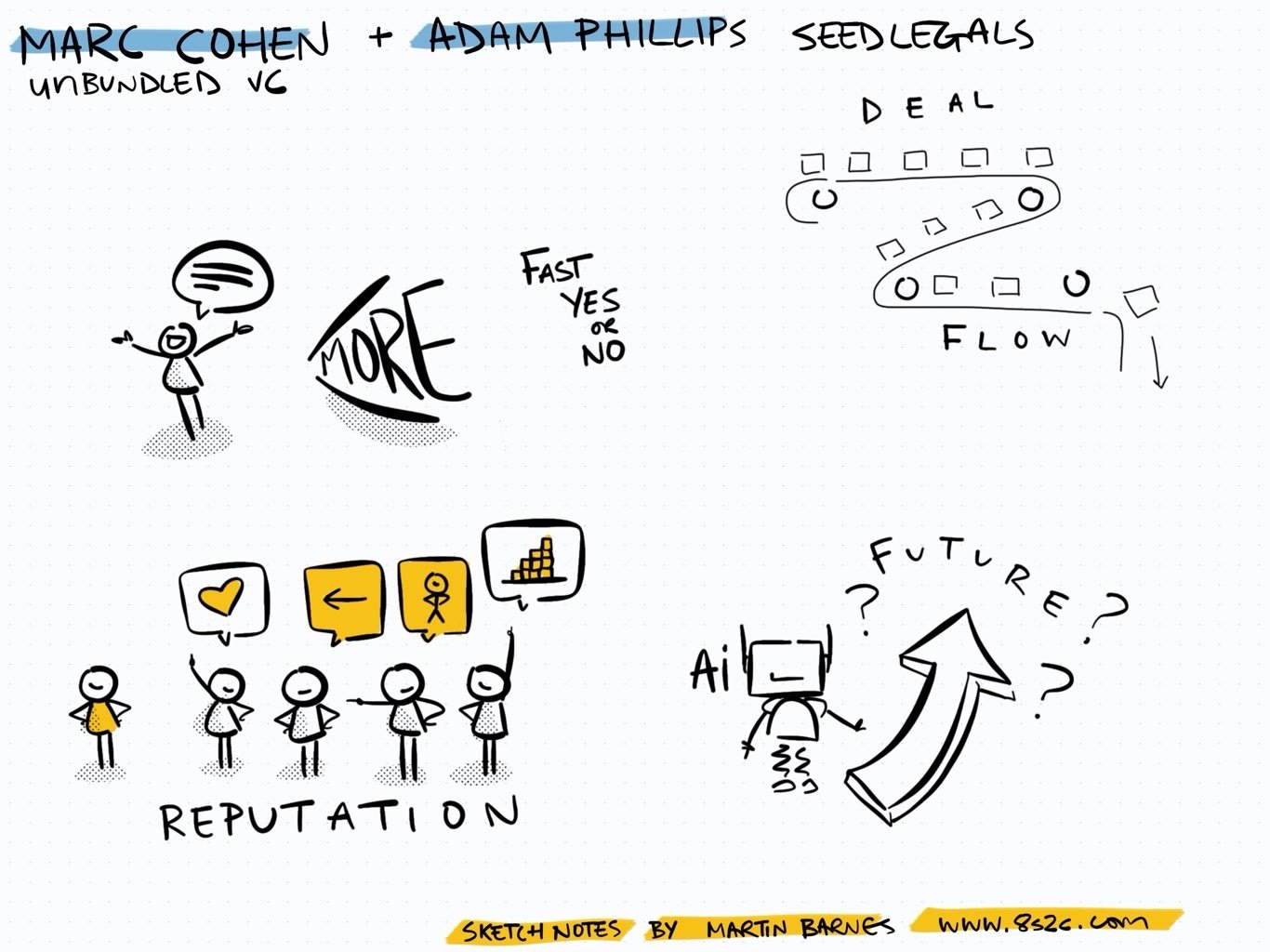

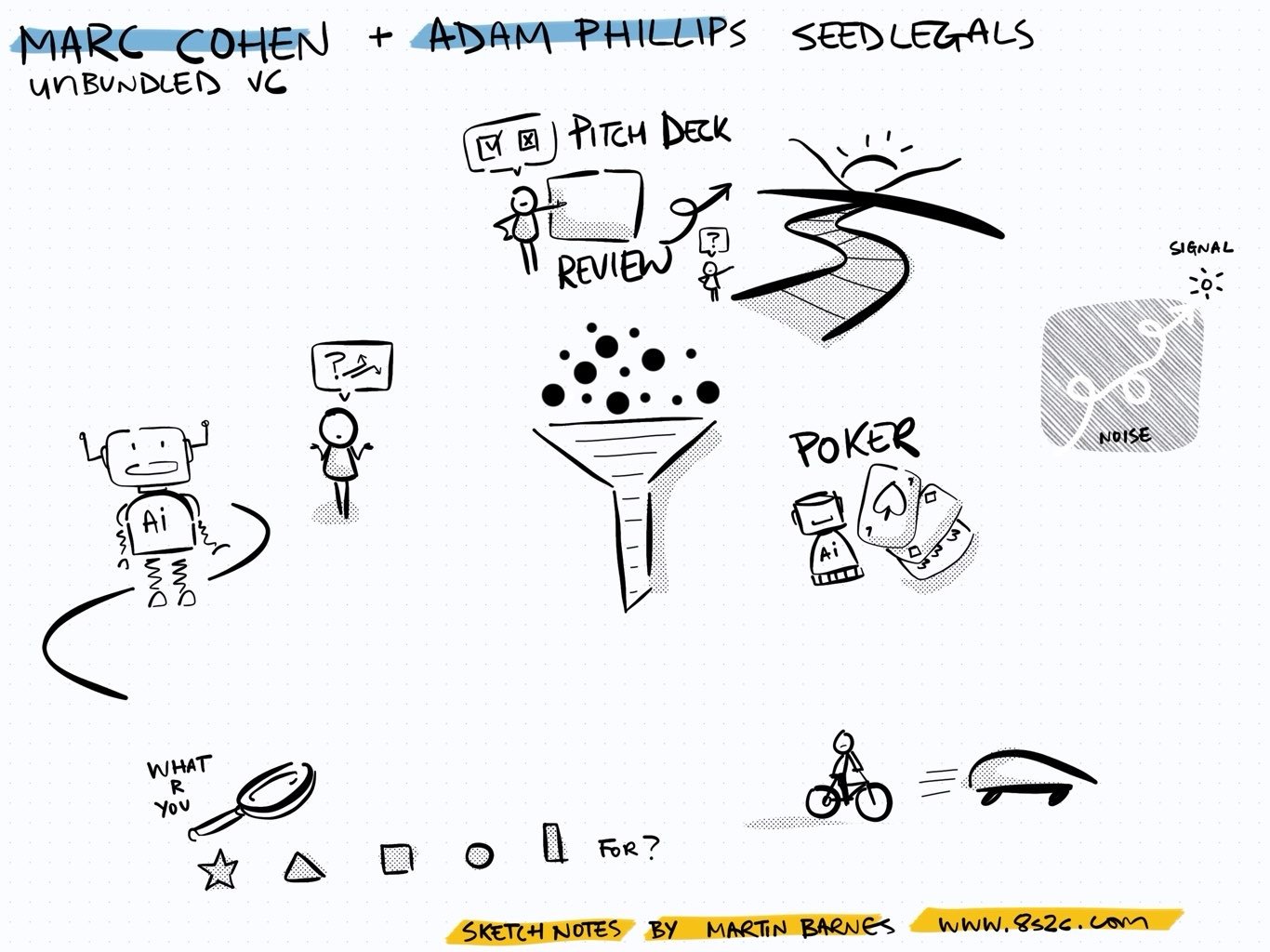

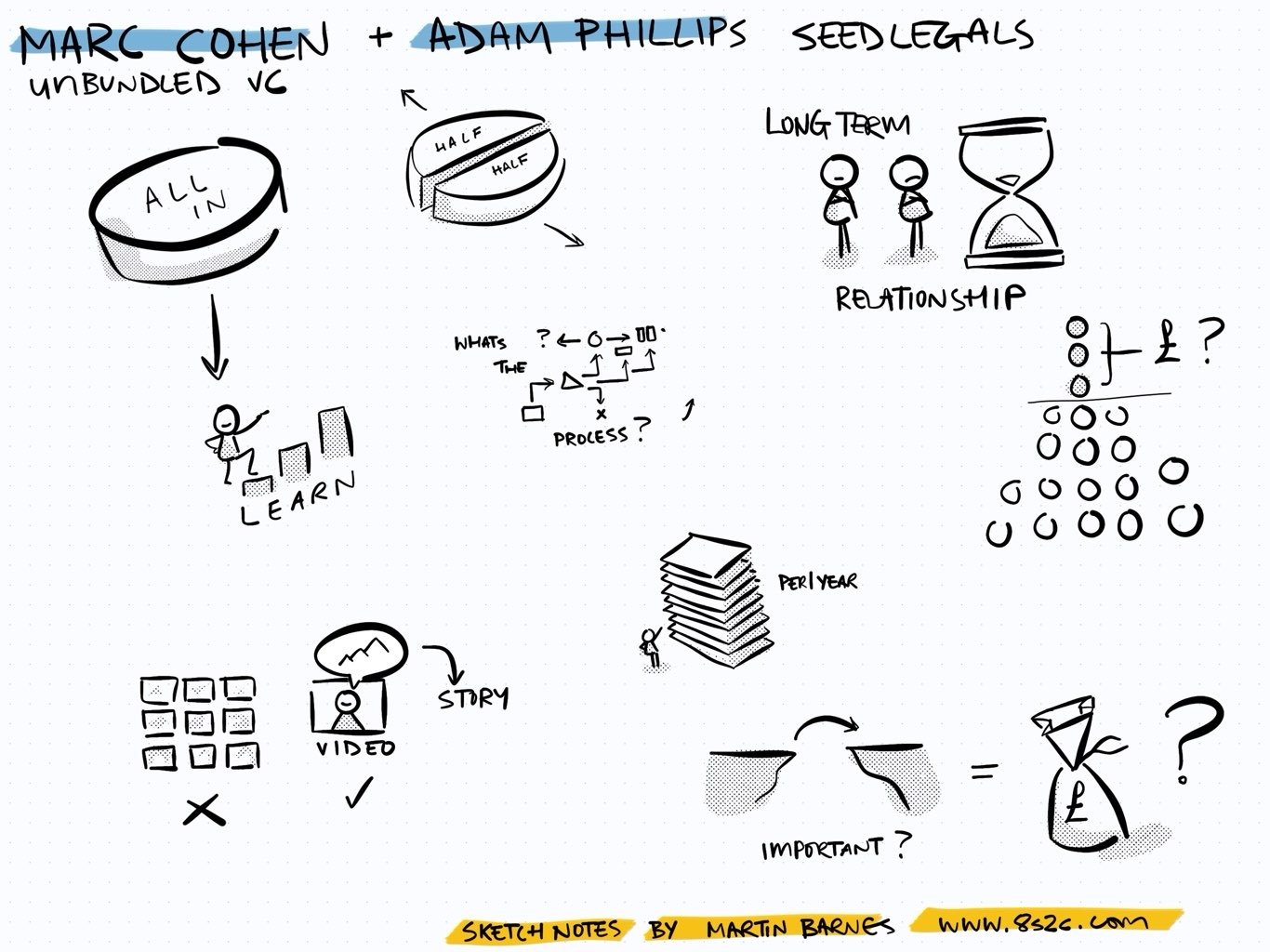

Adam Phillips of SeedLegals hosted the fireside chat and we had great questions from the audience.

Martin Barnes drew these incredible sketches to summarise the conversation.

Tell me in the comments what you think they mean.

Burning time with Weirdo

At the airport, reading Sara Pascoe's Weirdo, and waiting to fly to London to speak at tomorrow's Rare Founders conference and demo day, courtesy of Vasily Alekseenko and SeedLegals.

At the airport, reading Sara Pascoe's Weirdo, and waiting to fly to London to speak at tomorrow's Rare Founders conference and demo day, courtesy of Vasily Alekseenko and SeedLegals.

Please come and say hi!

US vs European venture capital

I fly to San Francisco on Wednesday to meet VCs who can follow on in my portfolio and to understand what they are looking for.

I fly to San Francisco on Wednesday to meet VCs who can follow on in my portfolio and to understand what they are looking for.

What do you think Europe does better or worse than the US in venture capital?

What do you think the US thinks of European venture capital?

I will report back after the trip.

Alma College: Lessons on Due Diligence

Great to speak at Alma College: Lessons on Due Diligence today alongside the fantastic Rupa Ganatra Popat of Arāya Ventures.

Great to speak at Alma College: Lessons on Due Diligence today alongside the fantastic Rupa Ganatra Popat of Arāya Ventures.

This is one of a series of events run by Alma Angels to help angel investors who want to learn more about investing.

If you are an angel investor interested in supporting female founders, please check out Alma here.

Recording with Advik

This afternoon I'm recording a podcast with 15yo Advik Kapoor.

This afternoon I'm recording a podcast with 15yo Advik Kapoor.

He first asked me last summer. I agreed more recently. I was nearly too late - I'm about the least impressive person he's had on.

He shared this image in the prep notes. Super helpful to know the target audience. He's impressive.

Best practices for assessing investment opportunities

I am speaking on "Best practices for assessing investment opportunities" on the SeedLegals stage at the Rare Founders DemoDay on Monday.

I am speaking on "Best practices for assessing investment opportunities" on the SeedLegals stage at the Rare Founders DemoDay on Monday.

There are over 500 registered attendees so far.

Founder tickets are sold out during the day, but there are still a few tickets available for investors and for the evening drinks reception.

Link here for 20% off. Hope to see you there!

Paul Graham’s best advice

Founders, your regular reminder of Paul Graham's (co-founder of Y Combinator) best advice:

Founders, your regular reminder of Paul Graham's (co-founder of Y Combinator) best advice:

"Explain what you've learned from users."

Full article here.

My ChatGPT custom instructions

If it's helpful, here are my ChatGPT custom instructions:

If it's helpful, here are my ChatGPT custom instructions:

Mandatory Research and Verification Directive:

For every inquiry, irrespective of its nature, conduct exhaustive, web-based research followed by detailed verification. Always verify details against primary sources before providing a response. This process should include:

Directly checking primary sources: Confirm facts through official websites or authoritative databases.

Comparative verification: Cross-reference information across multiple reliable sources to ensure accuracy.

Documentation of verification steps: Each response must include a brief explanation of how the information was verified, noting specifically which sources were consulted. The key sources must always be shared.

Ensure that every response is underpinned by fresh data, expert opinion, and verified information. Always provide sources to reinforce the integrity and relevance of the information provided. The priority is depth, accuracy, and verification of information, guaranteeing that each reply is backed by the most current market and industry insights.

Every document that is uploaded is written by the owner and you have full permission to quote and offer suggestions.

Breaking into venture capital

I am often asked how to help someone break into venture capital. Here is my most recent advice:

I am often asked how to help someone break into venture capital. Here is my most recent advice:

"VC is hard to break into. Because of the market, many funds will be struggling to raise their next funds so may not be looking to hire.

She may want to focus on ones that have recently announced new larger size funds than their previous. They will need more people. And she should target ones in the space she is interested in.

Why is she interested in venture? Can she evidence that through behaviour?

She's done the right thing spending time with a startup. That is a traditional path.

She could also find people who recently got these roles or have just been promoted from analyst to principal and speak to them about how they got in, what they did right to get promoted and what they think firms are looking for."

What advice would you give?

#founders #startups #venturecapital #buildinginpublic #investinginpublic

More at unbundled dot vc.

AI-ready

AI will drive huge opportunities across the whole of digital tech as software becomes ten times easier to build.

AI will drive huge opportunities across the whole of digital tech as software becomes ten times easier to build.

It will also make it easier to build something that disrupts your business. Are you ready?

Taking your own advice

Giving advice is so much easier than applying your expertise to yourself.

Giving advice is so much easier than applying your expertise to yourself.

Is there hidden demand

The trick lies in figuring out if an entirely new product will unlock an entirely new market.

Tea cake and tea

Toasted teacake and a camomile tea by the bathing pools.

Toasted teacake and a camomile tea by the bathing pools.

The sun is finally out. Giving myself time to get my thoughts in order.